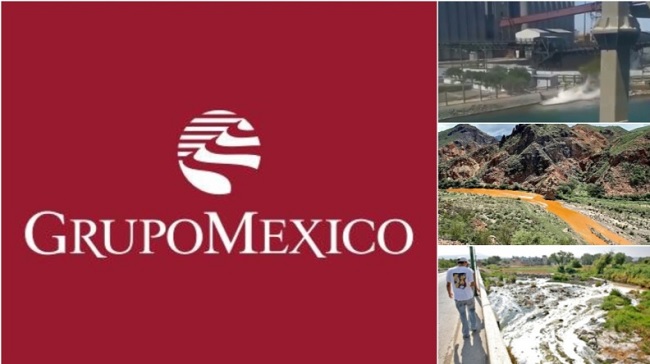

Mining and transport firm Grupo Mexico confirmed Tuesday it had terminated a high-profile construction contract to build an embattled tourist railway in Mexico’s southeast.

Executives said in an earnings call that it would no longer be building the Mayan Train, one of the government’s signature economic development projects currently under construction in Mexico’s southeast.

“We reached a neutral agreement with the government to hand over the Mayan Train project to the Defense Secretary Sedena,” a top executive said, adding that the decision came after multiple injunctions put the project’s completion in jeopardy.

The confirmation came after Grupo Mexico reported a 40.5% drop in its second-quarter net profit from the same period a year earlier, as sales fell while costs rose, according to a company filing.

Second-quarter net profit stood at $611 million, down from the $1.03 billion from the year-ago period.

One of the world’s largest copper producers and a major Mexican rail operator, Grupo Mexico also posted a 12% drop in copper production in the second quarter from last year.

The firm expects to see a further drop in copper production, especially in Chile and Peru, as U.S. demand decreases and tensions persist with local communities near its Peruvian mine Las Bambas, the group’s Vice Chairman Xavier Garcia De Quevedo Topete said during a call with analysts.

“We believe the economic slowdown in the U.S, China and Europe have temporarily weakened the demand for copper and are driving reductions in prices,” he said.

A community protest in Peru halted production at the company’s Cuajone mine for over a month back in March.

Grupo Mexico also said in the filing that the Los Chancas mining project in Peru, which is still under construction, was affected by protests between February and May too, which could impact its future production projections.

Brokerage JP Morgan said the Mexican company’s results for the period were “weak…as illegal strikes in Cuajone continued to impact volumes and consequentially costs”.

Asked about the group’s interest to buy Citigroup’s Mexican retail bank unit, a top executive said they continue to analyze M&A opportunities and look at prices to provide value for shareholders, without disclosing specific information of a bid.

Shares in Grupo Mexico were down 0.7% to 75.32 Mexican pesos.

Earnings before interest, tax, depreciation and amortization (EBITDA) for the quarter slid to $1.4 billion, a 41.2% drop year-on-year, and missing the Refinitiv estimate of $2.04 billion.

TYT Newsroom