Dark clouds are beginning to appear on the horizon, foreshadowing an economic and financial storm on the Mexican government’s finances.

(CDMX – EF) – Economic activity in Mexico contracted in the fourth quarter of 2021, making it two quarters with declines, mainly affected by the decline in the services sector and a weak performance in the industry.

With this result, some analysts consider that the economy entered a technical recession in the third quarter, but other specialists ruled it out.

Mexico’s economy contracted 0.1 percent in the last quarter of 2021 compared to the previous quarter, putting GDP in a technical recession.

Mexico’s economic activity contracted in the fourth quarter of 2021, making it two quarters with declines, mainly affected by the decline in the services sector and a weak performance in the industry.

With this result, some analysts consider that the economy entered a technical recession in the third quarter, but other specialists ruled it out.

Mexico’s economy contracted 0.1 percent in the last quarter of 2021 compared to the previous quarter, putting GDP in a ‘technical recession.

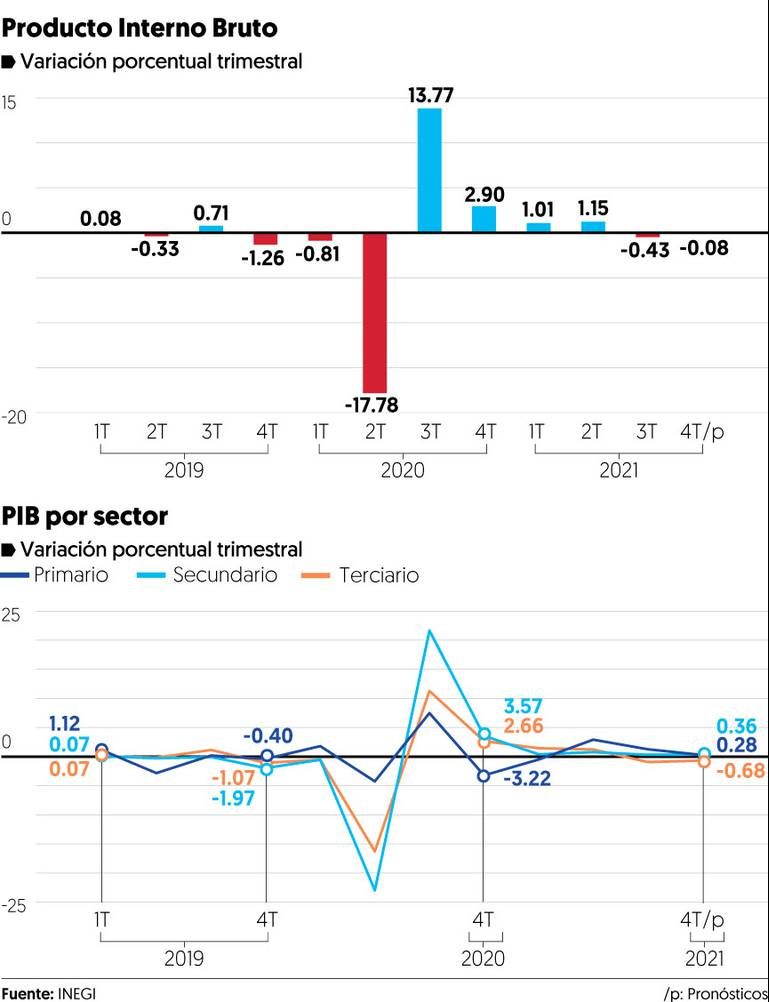

It should be recalled that in the third quarter, GDP contracted 0.4 percent compared to the previous quarter, interrupting a year-long streak of four consecutive quarters with gains, according to figures from the National Institute of Statistics and Geography (Inegi).

According to some analysts, a contraction of two consecutive quarters means a ‘technical recession.

Institutions such as Bank of America anticipated the entry into technical recession: the firm forecast an annual drop of 1.9 percent in the fourth quarter, after a 5.2 percent contraction in the third quarter. This factor led the bank to adjust its 2022 growth forecast for Mexico from 2.5 to 1.5 percent.

In the fourth quarter, by sector, the primary sector (which includes agriculture and livestock activities) rose 0.3 percent; the secondary sector (related to the industry) advanced 0.4 percent, and the tertiary sector (related to services, such as tourism) contracted 0.7 percent.

The final figure for the fourth quarter of 2021 will be released on February 25, when Inegi will publish the revised figures, so the 0.1 percent contraction may change.

So far this administration, quarterly GDP has recorded six quarters with declines and six with gains.

With the fourth-quarter drop, the economy is 3.0 percent below its pre-pandemic level, i.e., the fourth quarter of 2019.

Nikhil Sanghani, an emerging markets economist at Capital Economics, noted that the fourth-quarter GDP decline confirmed that the economy entered recession in the second half of 2021 and points to a weaker-than-expected performance for the current year.

“GDP contracted 0.1 percent in the fourth quarter of 2021, after falling 0.4 percent in the third quarter. Some call that recession,” noted Alonso Cervera, chief economist for Latin America at Credit Suisse, on his Twitter account.

Doubts for 2022

For BBVA, INEGI’s preliminary figures ‘cloud’ the outlook for economic growth this year, for which they foresee an advance of 2.2 percent, with downside risks associated with factors such as the omicron variant, the prolongation of bottlenecks, the higher level of prices, uncertainty for investors, as well as a more restrictive monetary policy.

“Considering the trend of weakness observed at the end of the year and the fact that the effects of the accelerated spread of the omicron variant will be more tangible in the first months of 2022, we are revising down our economic growth forecast for this year from 2.7 percent to 1.7 percent,” said Monex experts.

TYT Newsroom