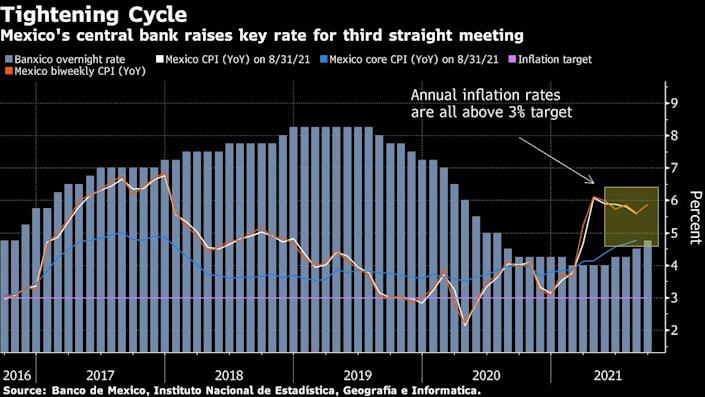

Mexico’s central bank raised borrowing costs for the third consecutive meeting, as policy makers struggle to slow above-target inflation.

Banco de Mexico, known as Banxico, increased its key interest rate by a quarter-point to 4.75%, in a 4-1 split decision. All but one of 26 economists surveyed by Bloomberg predicted the 25 basis-point hikes.

“Although the shocks that have increased inflation are expected to be transitory, due to their variety, magnitude, and the extended horizon over which they have affected it, they may pose risks to the price formation process and to inflation expectations,” the bank’s board wrote in a statement accompanying the decision.

Unlike in the previous two decisions, which were split 3-2, deputy governor Galia Borja voted for the hike this time. The bank increased its inflation forecasts, predicting a peak of 6.2% in the fourth quarter of this year and expecting it to hit 3.1% in the third quarter of 2023, instead of its previous projection of the first quarter.

“With the inflation expectations increase and with four of five members of the board voting for the hike this time, the probability of another hike this year increases,” said Gabriela Siller, director of economic analysis at Grupo Financiero BASE.

Mexico’s peso pared its intraday loss to trade down 0.2% at 20.55 per dollar after the decision. The currency was poised for a fifth straight decline and its weakest on a closing basis since mid-June.

Inflationary Spiral

Consumer prices in Mexico and across Latin America have spiraled up above official targets as economies reopen to pent-up demand and snarled supply chains. At the same time, households have faced surging food and energy costs, prompting Mexico’s government to impose a cap on prices for cooking gas last month. Inflation did ease somewhat in August, but headed back up in early September toward 6%, nearly twice the central bank’s 3% target.

The central bank forecast earlier this year that inflation would rise as the economy’s rebound gained traction, and then slow again as pandemic-related disruptions proved temporary. In fact, it’s spent 15 months above target since closing out May 2020 at 2.84%.

In a separate decision, Colombia also raised its interest rate by a quarter percentage point to 2% on Thursday. It was the first increase by the Andean central bank in five years, and it comes after consumer prices rose 4.4% in August from a year earlier.

Source: El Financiero

TYT Newsroom