Mexico’s central bank unexpectedly raised borrowing costs for the first time since late 2018 in a split decision as concern mounts that persistently elevated inflation may threaten the economy’s rebound.

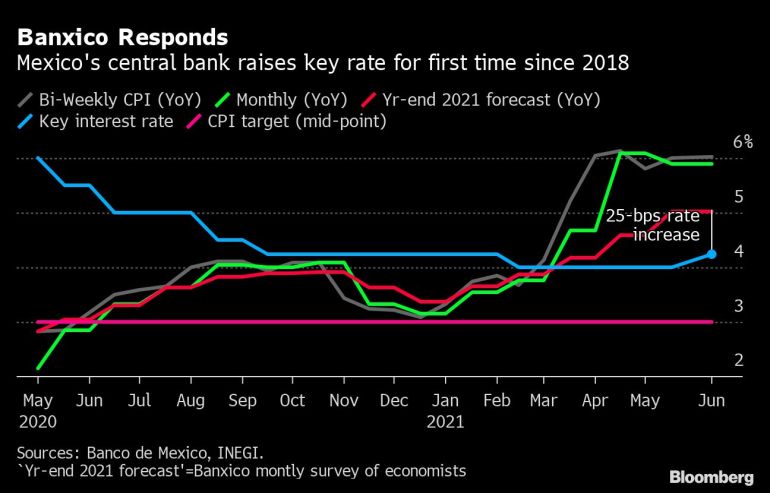

Banco de Mexico raised its key rate by a quarter-point to 4.25% in response to a jump in inflation that policy makers had previously described as transitory. The decision, supported by three of the five-member board, surprised all 23 economists surveyed by Bloomberg who had expected the bank to hold at 4%. Data published Thursday morning showed that inflation accelerated further in early June to 6.02%, also surprising analysts.

Banxico, as the central bank is known, targets inflation at 3%, plus or minus 1 percentage point.

“Although the shocks that have affected inflation are expected to be of a transitory nature, given their variety, magnitude, and the extended time frame in which they have been affecting inflation, they may pose a risk to the price formation process,” Banxico’s board said in the statement accompanying the announcement.

The bank now expects headline inflation to converge to the 3% target during the third quarter of next year, a quarter later than previously estimated.

The Mexican peso rallied 2% after the announcement, leading emerging markets currency gains.

“The move opens the possibility of another 25 basis-point hike,” said Gabriela Siller, director of economic analysis at Grupo Financiero BASE.

Mexico’s economy shrank 8.2% last year, the most in almost a century, and the bank’s easing has provided the only substantial form of economic stimulus during the crisis as the government kept an austere fiscal policy. The economy has rebounded faster than expected so far in 2021, adding to inflationary pressures, with the bank projecting 6% growth for the year.

Inflation had peaked in April at 6.1% this year in comparison to the year before, but the rate has barely declined since then, complicating the central bank’s task after initially saying that the inflationary spike would be momentary. Prices have been driven up by supply shocks and U.S. inflation.

Thursday’s decision is the first since President Andres Manuel Lopez Obrador nominated Finance Minister Arturo Herrera to become Banxico governor when current leader Alejandro Diaz de Leon steps down at the end of the year.

SOURCE: BLOOMBERG