Mexico, Chile, Peru to Keep Key Rate on Hold

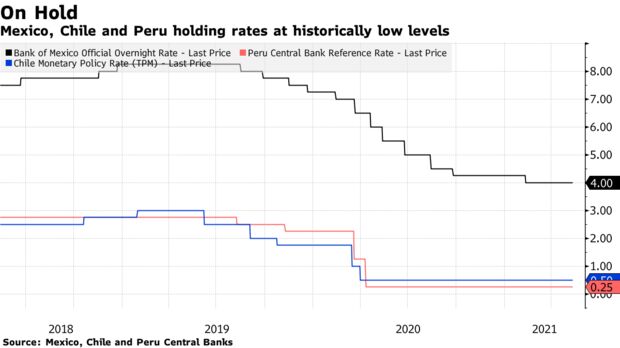

(Bloomberg).- Mexico, Chile and Peru are all expected to hold their key interest rates near or at all-time lows in a bid to support their economies even as inflation spikes and political instability grows in Latin America.

Every economist polled by Bloomberg expects central banks from those three countries to hold rates in separate decisions on Thursday — a stark contrast with Brazil, where policy makers have already delivered two hikes of 75-basis points since March and promised a third one of the same size for June.

“Most central banks across the region might remain cautiously on hold, on a rather neutral mode waiting to see more developments on inflation, the recovery and the evolution of local political developments,” said Marco Oviedo, chief Latin America economist at Barclays Plc.

Any desire to cut will likely be tempered by above-target inflation in Mexico, and concerns over market stability ahead of elections in Peru.

Mexico’s Resilient Inflation

- Current rate: 4%

- Time of decision: 2 p.m. ET

The door for additional rate cuts remains closed in Mexico as rising fuel and food costs catapulted annual inflation to 6.1% in April, more than double the 3% target.

Deputy Governor Gerardo Esquivel said last month he expects the price spike to be temporary, since prices are being compared against a deep slump this time last year, with inflation falling within the bank’s range in July. But many economists are less optimistic, starting to anticipate a rate hike in late 2021 or early 2022.

High prices will continue “due to real inflationary pressures caused by the economic reopening in the Mexican services sector and the global increase in commoditiy prices,” said Gabriela Siller, director of economic analysis at Grupo Financiero BASE.

What Bloomberg Economics Says

“Mexico’s central bank is likely to hold the key interest rate at 4% on Thursday. Policy makers may sound a more cautious tone than in the last gathering due to high and resilient inflation through April. Some may keep the door open for additional accommodation, depending on new information.”

— Felipe Hernandez, Latin America economist

Click here for the full report.

Chile’s Low Rate Pledge

- Current rate: 0.5%

- Time of decision: 6 p.m. ET

Chile is forecast to hold its benchmark interest rate at a record-low, as the central bank says inflation will accelerate above target in coming months before returning to the 3% annual goal by December.

Board members have also signaled borrowing costs will remain steady at least through year’s end. Any changes to that language may signal rates will move higher sooner rather than later. Indeed, consumer prices rose more than expected in April to 3.3% from the year prior, prompting analysts at Banchile Inversiones and Oxford Economics to raise their 2021 inflation forecasts.

In a meeting with President Sebastian Pinera last week, board members reaffirmed the need for expansive public policies to drive a recovery that remains uneven. The government is unwinding virus quarantines which subjected 90% of the population to strict limits on commerce and movement. Policy makers are also on hold as Chile enters a period of political uncertainty, with the election of an assembly to rewrite the constitution on May 15-16 and a presidential election in November.

Peru’s Election

- Current rate: 0.25%

- Time of decision: 7 p.m. ET

Peru is forecast to hold borrowing costs at a record low for the 13th month in a row, fulfilling its pledge to keep supporting a pandemic-ravaged economy.

Increasing political uncertainty and growing market volatility ahead of next month’s presidential runoff are likely to contribute to the bank’s decision to stay on hold for now.

Peruvian bonds and currency crashed last month when Pedro Castillo, a little-known school teacher from a Marxist party, unexpectedly won the first round of elections. In recent days, they’ve recovered some of their losses as Castillo’s lead over former congresswoman Keiko Fujimori narrowed to within the margin of error.

Source: Bloomberg