- Recent months have seen Brazil’s manufacturers enjoy the strongest expansion in the PMI’s 14-year survey history

- Mexico is in its steepest downturn for at least a decade

- Survey data point to marked variances, in exports, domestic demand and business confidence

Brazil is leading the global manufacturing recovery, while Mexico continues to suffer an especially steep decline. PMI survey data help to identify the causes of the divergence, which include differences in exchange rates, business confidence and the pandemic stimulus.

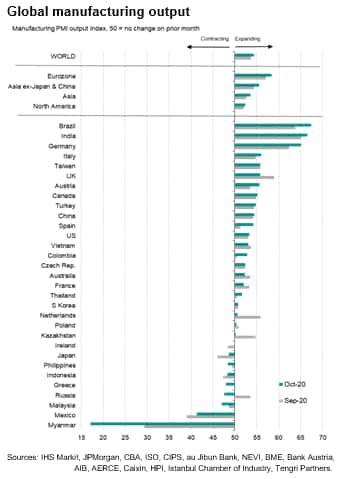

Although the JPMorgan Global Manufacturing PMI, compiled by IHS Markit from its proprietary business surveys, rose from 52.4 in September to 53.0 in October, its highest since May 2018, the recovery of the manufacturing sector has by no means been universal. Of the 31 countries covered by the surveys, factory output rose in 22 but fell in nine during October. However, most striking is the divergence between the two countries which have sat at opposite ends of the PMI ranking table in recent months: Brazil and Mexico.

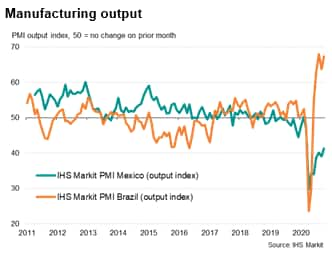

In the three months to October, the manufacturing PMI output index for Brazil has averaged 66.4, surpassing any rate of expansion seen since the survey began back in 2006 by a wide margin. By comparison, the output index for Mexico has averaged just 40.2 over the same period, indicating a contraction of production the severity of which has been exceeded over the past decade only by that seen at the height of the pandemic earlier in the year.

The PMI data also show that output in Brazil fell for just three months at the height of the COVID-19 pandemic, between March and May 2020, whereas Mexico’s output has fallen continually since March.

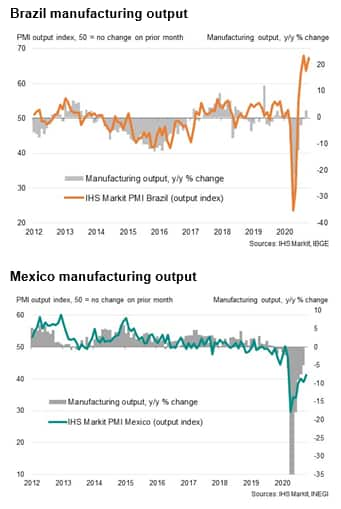

Brazil’s manufacturers’ have already recovered to above levels of a year ago

The divergent performance is also reflected in the official data, which are only available with a delay compared to the PMI and hence only currently show the situation up to September. However, these data already indicate that output in Brazil had risen 2.5% above levels of a year ago whereas output in Mexico continued to run some 5% below September of last year, corroborating the divergent trends signalled by the PMI surveys.

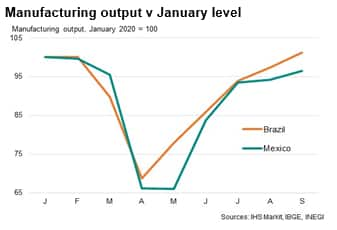

Similarly, September’s output in Brazil had recovered to a level 1.1% higher than in January while Mexico’s production remained 3.5% below that seen at the start of the year.

The differing recovery rates only partially reflect the depths of the downturns at the height of the pandemic from which both countries are recovering. In Brazil, output had collapsed by 31% in April compared to its level at the start of the year whereas in Mexico the slump was only slightly larger at 34%.

Virus containment

The different recovery speeds also do not reflect variances in the degree and timing of lockdowns to fight rising COVID-19 infections, which have been similar.

The degree to which economies have ‘locked down’ in the fight against the pandemic can be gauged by IHS Markit’s COVID-19 Containment Index. This gauge is based on a basket of measures applied by governments to control the spread of the pandemic, such as non-essential business closures, school closures and travel and mobility restrictions linked to social distancing policies. As these measures are tightened, the index rises towards 100 and a relaxation of measures causes the index to fall towards zero.

Both Mexico and Brazil locked down their economies to similar extents between April and July. Although Mexico subsequently relaxed some restrictions slightly earlier than Brazil, containment measures are now less severe in Brazil than Mexico. The result is that the average containment scores seen over the course of the pandemic have been very similar: an average of 46.3 for Mexico (up to November) against 46.8 for Brazil.