Amazon sales estimates have moved higher as most outlooks decline due to COVID-19 pandemic.

Amazon.com Inc. shares closed at a new high Tuesday, as the e-commerce and cloud-computing powerhouse continued to be seen as a safe target for investors in a rocky time.

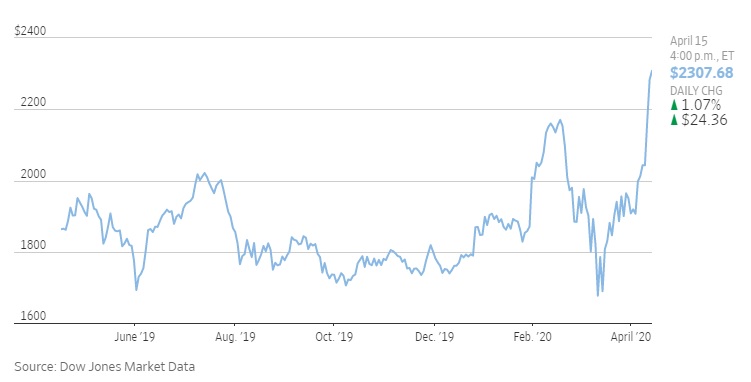

Amazon AMZN, +1.06% stock gained 5.3% Tuesday to close at an all-time high of $2,283.32, topping the previous closing record of $2,170.22 set on Feb. 19. At that price, Amazon is worth roughly $1.14 trillion, according to FactSet. Shares have gained 23.6% this year, as the S&P 500 index SPX, -2.20% has declined 14.5% amid fears of a recession caused by the COVID-19 pandemic.

While investors are concerned about the coronavirus pandemic’s effects on companies, Amazon seems relatively safe thanks to its core businesses: online retail, which is thought to have picked up amid closures of brick-and-mortar outlets; cloud computing, which helps companies keep up with increased demand for online products as people flood the internet; and streaming media, a popular pastime for those who are forced to stay at home.

Analysts have increased their sales expectations for Amazon even as estimates for most companies trend downward. On average, analysts now expect Amazon will collect $72.49 billion in first-quarter revenue and $334.14 billion for the year, up from $72.21 billion and $334.05 billion at the end of January.

In a Monday note, Cowen analysts said that the “COVID-19 surge led to ‘Prime Day in March’” for the company’s core e-commerce business.

“In most verticals, Amazon has seen an ’enormous increase in demand’ as shoppers are forced to stay home, essentially creating an extended Prime Day/Black Friday type of situation,” they wrote.

One concern from analysts is that Amazon could accelerate spending faster than any revenue growth, as the company has been known to do to build for long-term ambitions. Amid the spread of COVID-19, the company said it would seek to hire 100,000 workers, and then added an additional goal of 75,000 workers to that total last week.

Amazon has proved its willingness to spend can be beneficial in previous efforts, such as building out its fulfillment network and cloud-computing data centers. In the past year, it has been spending to improve its delivery efficiency with an eye on faster and better grocery delivery, which could be paying off right now.

RBC Capital Markets analyst Mark Mahaney wrote in a note last week that a survey showed more than half of those who were buying groceries online during the COVID-19 pandemic believed their willingness to buy groceries online would be permanently increased by the experience, and one-third had ordered groceries online for the first time in the past 30 days.

“Our survey clearly suggests growing adoption AND a major inflection point in online groceries, with numerous industry datapoints confirming,” Mahaney wrote while maintaining an outperform rating on the stock. “If Amazon is able to optimize the customer experience — a very challenging proposition in this environment — it stands to dramatically benefit, with groceries becoming a material (10%+) portion of its revenue by 2023, per our new analysis.”

Analysts are nearly in unanimous lockstep on Amazon’s stock, with 46 of 48 analysts tracked by FactSet rating the stock a buy, and the other two calling it a hold. The average price target as of Tuesday was $2,436.55, about 6.2% higher than the closing price.

Source: https://www.marketwatch.com/